MASTER KSeF LIKE A PRO

KSeF Connector GoNextStage

Starting February, large companies are required to implement the National e-Invoice System (KSeF). Now is the time to automate!

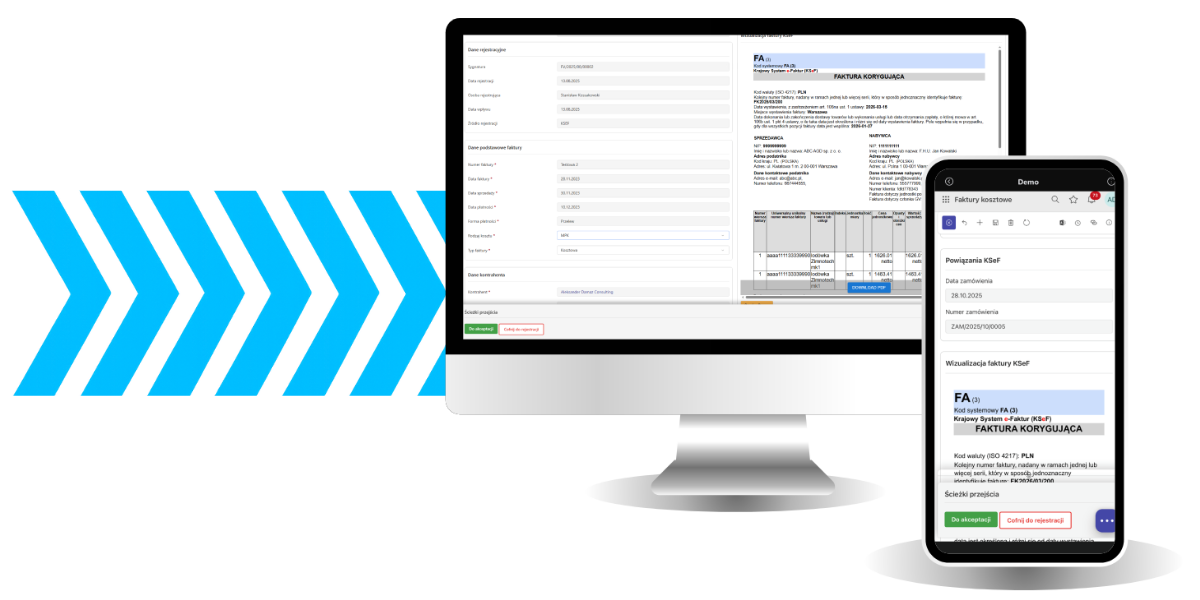

Start using the KSeF Connector by GoNextStage – an app that seamlessly integrates KSeF with your company’s invoice workflow.

See how it works!

What is Polish National e-Invoicing System (KSeF)?

It’s an IT system that enables issuing, receiving, and storing structured invoices in XML format. It enbales inegration with worfklow or ERP system via public API.

How does the KSeF Connector make KSeF easy?

The KSeF Connector by GoNextStage automatically connects to KSeF, retrieves XML invoices from the system and sends them to the ERP even several times a day.

Invoices are instantly processed and displayed in a clear, user-friendly format, making analysis easier and reducing errors.

The entire process is fully automated – no need to log in to the government platform.

Why implement the KSeF Connector by GoNextStage?

Full compliance with Polish Ministry of Finance requirements

Automation and complete control over invoice workflows

KSeF XML to PDF conversion

Integration with any workflow or ERP system (SAP, Oracle, Microsoft)

Stages of implementation

Pre‑implementation analysis

where we get to understand your needs better

Joint invoice field mapping

with tool simplifying invoice conversion to XML

Implementation

configuration of the KSeF Connector and integration with your BPM or ERP system

Enhanced reporting

enabled by well‑mapped, high‑quality data retrieved from KSeF

Cost Invoice Workflow with KSeF Connector

1. Document registration

Invoices enter the organization as paper (e.g., receipts), PDFs (via a dedicated email inbox), or through KSeF.

2. Data reading (OCR)

Paper and PDF documents are automatically read using OCR technology.

3. XML conversion & analysis

The KSeF Connector converts XML invoices into PDF for easy review, allowing you to verify contractors and link documents to contracts or purchase orders.

4. Approval process

An invoice owner adds details and sends it for approval.

5. Accounting verification

The accounting team checks the document and applies corrections if needed.

6. ERP integration & monitoring

The invoice is sent to the ERP system with a preview link. The system automatically updates payment status.

Frequently Asked Questions (FAQ)

KSeF applies to all VAT payers in Poland — that is, companies and entrepreneurs registered as taxpayers under the Value Added Tax system.

The penalty can reach up to 100% of the VAT amount shown on an invoice if it was issued outside the KSeF system. For invoices without VAT, the Head of the Tax Office may impose a fine of up to 18.7% of the total amount due on that invoice.

Penalties may be imposed for:

- Failure to issue an invoice via KSeF

- Issuing an invoice outside the official government system

- Errors in invoices submitted to KSeF

It’s also important to note that taxpayers have 14 days from the date of receiving the administrative decision to settle the imposed penalty.

On the KSeF side, the process looks like this:

- Invoice creation – the entrepreneur generates an XML invoice according to FA schema

- Submission to KSeF – the invoice is sent to the Ministry of Finance’s central database

- Validation – the system checks the document and assigns a unique KSeF number

- Official Receipt Confirmation (UPO) – the issuer receives confirmation of registration

- Recipient access – the recipient can download the invoice after authentication

You have three options:

- Via the KSeF portal – free, no extra software, but manual data entry is time-consuming and error-prone

- Through your ERP system – once integrated with KSeF, invoices can be issued automatically

- ERP + document workflow system – the most advanced option for medium and large companies, enabling full automation, compliance, cost control, and easy financial reporting

First, choose your preferred method of handling KSeF. Then review the types of invoices you process. Next, set up permissions and access – generate tokens and certificates. Finally, arrange training and process testing.

Our analysts have prepared a 7-step checklist to make implementation easier. Download it today!

If your organization is registered in Poland (with a Polish NIP), treat the invoice like any domestic one. If not, proceed as before KSeF – send invoices by email or post, skipping the National System. Learn more in our article: KSeF and Foreign Invoices.

An electronic structured invoice in the National e-Invoice System (KSeF) is a document confirming the sale of goods or services, stored in XML format. It is a fully digital invoice, compliant with current legal regulations, and replaces the traditional paper invoice. Structured invoices exist exclusively in electronic form and meet the requirements set by the Ministry of Finance, following a standardized logical data model.

Using the KSeF system and issuing e-invoices entitles the taxpayer to receive a VAT refund within 40 days — that’s 20 days faster than the standard timeframe.

The KSeF system does not allow additional files to be attached directly to an invoice. That’s why the KSeF Connector by GoNextStage enables automatic collection and assignment of attachments sent by contractors.

- Dedicated mailbox for attachments

Each attachment is sent to a dedicated email inbox designed exclusively for receiving documents related to invoices. The system automatically processes incoming messages, downloads attachments, and analyzes their content to identify the invoice they should be linked to. - Automatic assignment in WEBCON BPS

Once correctly identified, attachments are automatically added to the appropriate invoice workflow in the WEBCON BPS system, ensuring complete documentation and process continuity. - Manual review when needed

If the system cannot clearly match an attachment to a specific invoice (e.g., due to missing document numbers in the email), the file is routed to a separate process. Here, an operator can manually assign it to the correct record, guaranteeing full control over document flow and completeness.

According to the amended VAT Act, between April 1 and December 31, 2026, micro-entrepreneurs will be allowed to issue invoices outside the National e-Invoice System (KSeF), provided they meet two criteria:

- The value of a single invoice does not exceed PLN 450

- The total monthly sales value does not exceed PLN 10,000 gross

See how it works

Book a demoCONTACT US