3 min

Structured Invoices: A Legal Requirement and a Digital Opportunity

Starting April 2026, the Polish National e-Invoicing System (KSeF) will introduce a new standard for financial documents: the structured invoice. For accounting teams, this marks a major shift in daily operations. Is your organisation ready? In this article, we’ll walk you through the structure of e-invoices and share practical tips on how to turn this regulatory change into a springboard for digital transformation.

Table of contents

- What is a structured invoice?

- How to handle XML structured invoices in your organisation? Automation is everything

What is a structured invoice?

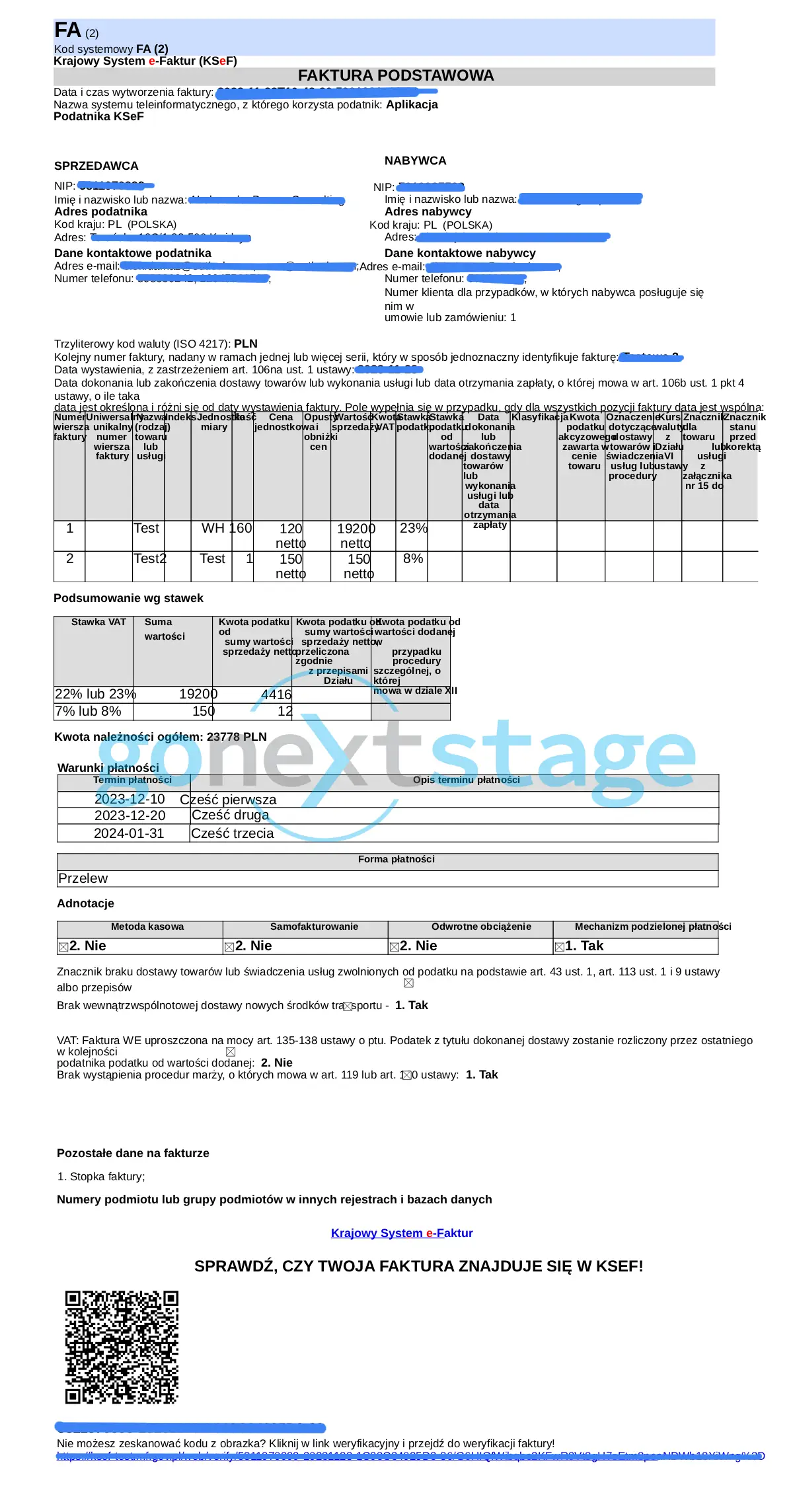

A structured invoice is a specific type of electronic invoice — and from next year, it will become the foundation for VAT settlements in Poland. It’s delivered in XML format, and its content must follow the logics defined by the Ministry of Finance. The current version is known as FA(3), and it requires the following data:

- issuer details (address, contact info),

- buyer information, including their ID,

- details of any authorised third party (e.g. bailiff),

- transaction data, amounts, and summary (currency code per ISO4217, invoice date, invoice number),

- optional comments.

If any mandatory fields are missing, KSeF will reject the invoice. That’s why it’s crucial to have a tech solution that validates XML files against the official structure.

And there’s more to come — new invoice templates are expected in the future, so flexibility in managing document formats will be crucial.

Structured vs. electronic invoice — what’s the difference?

An electronic invoice is a broad term. It includes scanned documents (JPG, PNG), text files, and PDFs. A structured invoice, on the other hand, is a specific XML file designed for automated processing.

How to handle XML structured invoices in your organisation? Automation is everything

Structured invoices can only be issued and received via KSeF. While the Ministry of Finance offers a free Taxpayer App, its manual nature poses challenges for businesses. Manually uploading, downloading, and sending invoices is time-consuming — and error-prone.

The good news? KSeF comes with an API that allows integration with external IT systems. That means you can turn a compliance task into a strategic advantage. Instead of adding manual work, you can fully automate your accounting processes — using the systems you already rely on.

You can achieve full automation with your invoice flow thanks to integration with KSeF. If your organisation uses WEBCON BPS or Microsoft Power Platform, KSeF Connector by GoNextStage is a perfect match. This ready-to-use application acts as a bridge between your internal invoice workflow and the National e-Invoicing System. It lets you work in a familiar interface, while ensuring full compliance with government requirements.

Here’s what you get with KSeF Connector:

- End-to-end automation – invoices are sent and received seamlessly, and automatically assigned to the right cases and approval paths.

- Regulatory peace of mind – the connector is continuously updated to meet the latest Ministry of Finance standards.

- Real-time alerts and control – automatic notifications about invoice status and rejections, which the standard KSeF app doesn’t provide.

- Instant access to data – all invoices are archived and searchable within your system, making audits, reporting, and analysis easier.

Learn more about KSeF Connector.

One more thing to keep in mind

When it comes to cost invoices, simply implementing the KSeF Connector isn’t enough. A successful rollout also requires a broader project to adapt your existing invoice workflows to a new data source — KSeF.

It’s worth starting with an internal business analysis that covers, among other things:

- mapping fields for all invoice types,

- handling offline modes and KSeF outages,

- using additional invoice data — such as links to purchase orders or contracts.

Proper preparation helps minimise operational risks and unlock the full automation potential that KSeF brings.

– Stanisław Korwin-Kossakowski, Solution Architect GoNextStage

Final thoughts

KSeF implementation can be a turning point — not just a legal obligation, but a chance to fully automate your financial workflows. Manual document handling in the government app is slow and inefficient. But integration with your existing systems transforms this challenge into an optimisation opportunity.

KSeF Konektor by GoNextStage ensures compliance, streamlines operations, and gives you full control over one of your organisation’s most critical processes.